Ahead of the inaugural online event Additive Manufacturing Advantage: Aerospace, Space, and Defense 3D Printing Industry is running a series of articles focused on the application of 3D printing in these critical sectors. Register now for AMAA 2024 on July 16th to hear more insights from sector leaders.

During an interview at RAPID + TCT 2024, Velo3D’s CEO Brad Kreger outlined how the company has adapted to the changing needs of the aerospace, space and defense industries.

Appointed as CEO of the metal 3D printer manufacturer in February 2024, Kreger has witnessed the defense sector transform over the past six months. This has been characterized by increased 3D printer demand and an urgency to accelerate adoption, driven by global conflict and increasing supply chain insecurities.

He believes the “3D printing industry is in a state of recalibration,” and that additive manufacturing is no longer seen as the “panacea that solves all problems.”

The Velo3D CEO rationally argues 3D printing offers significant value for low-volume, high-mix production of large-scale, mission-ready parts. Here, Velo3D’s technology can reduce supply chain timelines from months to weeks, enabling flexibility and cost efficiencies for manufacturers.

Turning to how to overcome barriers in aerospace 3D printing, Kreger emphasized the need to advance quality assurance capabilities and regulatory standards. He believes growing 3D printing adoption in military applications will increase confidence within the civilian aviation and aerospace sectors.

Discussing the profitability challenges facing 3D printer equipment manufacturers, he highlighted the importance of generating peripheral revenue streams. For Velo3D, this includes its service support, material development, and Flow Developer software offerings.

Read all the news from RAPID + TCT 2024

3D printing for aerospace, space, and defense

The aerospace, space, and defense industries are “strongholds” for Velo3D. The company offers laser powder bed fusion (LPBF) 3D printers optimized for large-format metal parts. For example, its Sapphire XC system was recently selected to support the U.S. Naval Nuclear Propulsion Program.

Kreger stated that calculating the total addressable market for aerospace, space, and defense is challenging due to industry fluidity. “If I were to answer that question six months ago, it’d be a much more conservative answer to what I would provide now,” he explained.

The Velo3D CEO acknowledged that it is measured in billions of dollars, pointing to the US Defense budget passed in March 2024. This allocated over $800 billion to defense spending, a “very large portion” of which was earmarked for additive manufacturing.

When asked how the company stands out in these high-value markets, Kreger highlighted Velo3D’s non-contact recoater blade technology. Most LPBF 3D printers feature recoater blades that spread the metal powder over the build plate through physical contact. This can create defects in parts and limit design complexity.

The company’s recoater blades are suspended above the powder bed, using controlled air flow to spread material more evenly. This enables complex 3D printed geometries and angles that “our competitors are not able to achieve.”

Another crucial differentiator for Velo3D is reproducibility. “You can qualify a part on our 3D printers, and then reproduce that same part on any other system,” he explained.

This unlocks the potential for geographically distributed manufacturing. For instance, SpaceX currently possesses 25 of the company’s 3D printers. When the US-based private space company experiences a surge in demand, it leverages Velo3D’s network of contract manufacturers to meet production requirements.

How scalable is additive manufacturing?

Kreger sees “massive potential” for scaling additive manufacturing, noting that the company’s customers target production applications. This demand is particularly prevalent among defense firms that want to move from casting to additive manufacturing. According to the CEO, many of these companies have reportedly identified the need for ten to fifteen 3D printers to supplant current supply chains, giving Velo3D “good visibility to continue scaling.”

Kreger explained that 3D printing production runs are highly variable and determined by the application. Velo3D’s technology is mainly used for small runs of large-scale metal parts. With 3D print times of up to ten days, customers generally fabricate hundreds of these parts a year.

The time savings offered by the company’s 3D printers are “transformative,” Kreger stated. When using conventional manufacturing, large-scale components can comprise between five to fifty different parts, each with a unique supply chain.

These separate elements, produced using casting, waterjet cutting, or machining methods, need to be assembled and individually post-processed. “That supply chain can span 12 to 18 months,” Kreger argued. He highlighted the potential for failure points and unreliability in this extended process. In contrast, additive manufacturing condenses large parts into a single-build process. This reduces failures and streamlines the supply chain timeline to “four to six weeks.”

Kreger emphasized the flexibility and cost-efficiency of 3D printing, particularly for low-volume, high-mix production. He argued that creating a traditional supply chain is costly and only justifies investment when producing large volumes. Instead, additive manufacturing allows customers to manufacture smaller runs of unique parts at a low cost. “That flexibility is something customers really value,” added Kreger.

How to increase 3D printing profitability

The 3D printing industry faces a significant profitability challenge, especially among hardware manufacturers. “Equipment manufacturers across the board have been struggling with profitability,” stated Brad Kreger. He believes that increasing adoption is key to overcoming this.

Kreger suggests that manufacturers should pursue a more holistic approach that is properly monetized. This includes generating peripheral revenue streams beyond just selling 3D printers.

Velo3D, he explained, had previously been laser-focused on systems sales to achieve core revenue. However, to improve the company’s top line and financial outlook, “we’re now taking a different perspective and looking at services and support.” This includes application support, material development, and service support.

“The 3D printer is not the only component of the business model. Manufacturers need to encompass the whole set of values and convert that into revenue,” Kreger added.

Overcoming challenges for flight-ready parts

The Federal Aviation Administration (FAA) is still transitioning from machining to 3D printing. This shift, according to Kreger, requires a fundamental change in how component quality is assured and regulated.

Conversely, growing operational risks are accelerating the adoption of additive manufacturing in the defense sector. “The military and government are realizing that they need to speed up their efforts to be properly equipped,” explained Kreger.

Indeed, 3D printing is increasingly used to address shortages of critical defense equipment. The US military is witnessing a high demand for missiles and a shortage of domestic suppliers. To address this, the US Navy has contracted Ursa Major to design, manufacture and hot-fire test 3D printed solid rocket motors (SRMs) to power its SM-2, SM-3, and SM-6 missiles.

According to Kreger, increasing adoption in defense will boost confidence in civilian applications. 3D printing for military aircraft will provide a “wealth of data and a body of evidence” that can be used to ease aviation and aerospace regulatory challenges.

Security is a paramount concern when producing parts for defense applications. Kreger points to the stringent cybersecurity standards demanded by the US Department of Defense (DoD), particularly Security Technical Implementation Guide (STIG) compliance.

According to Kreger, Velo3D is uniquely positioned to meet these requirements. “We are the only manufacturer that has STIG compliance and what they call the green status,” he stated.

This ensures that sensitive file data is not externally accessible or residually available once the part has been completed. “Data security is absolutely critical in defence, and we’ve made a specific industry investment to provide that solution,” Kreger added.

Register now for AMAA 2024 to hear insights from industry experts on additive manufacturing in aerospace, space, and defense.

Want to help select the winners of the 2024 3D Printing Industry Awards? Join the Expert Committee today.

What does the future of 3D printing hold?

What near-term 3D printing trends have been highlighted by industry experts?

Subscribe to the 3D Printing Industry newsletter to keep up to date with the latest 3D printing news.

You can also follow us on Twitter, like our Facebook page, and subscribe to the 3D Printing Industry Youtube channel to access more exclusive content.

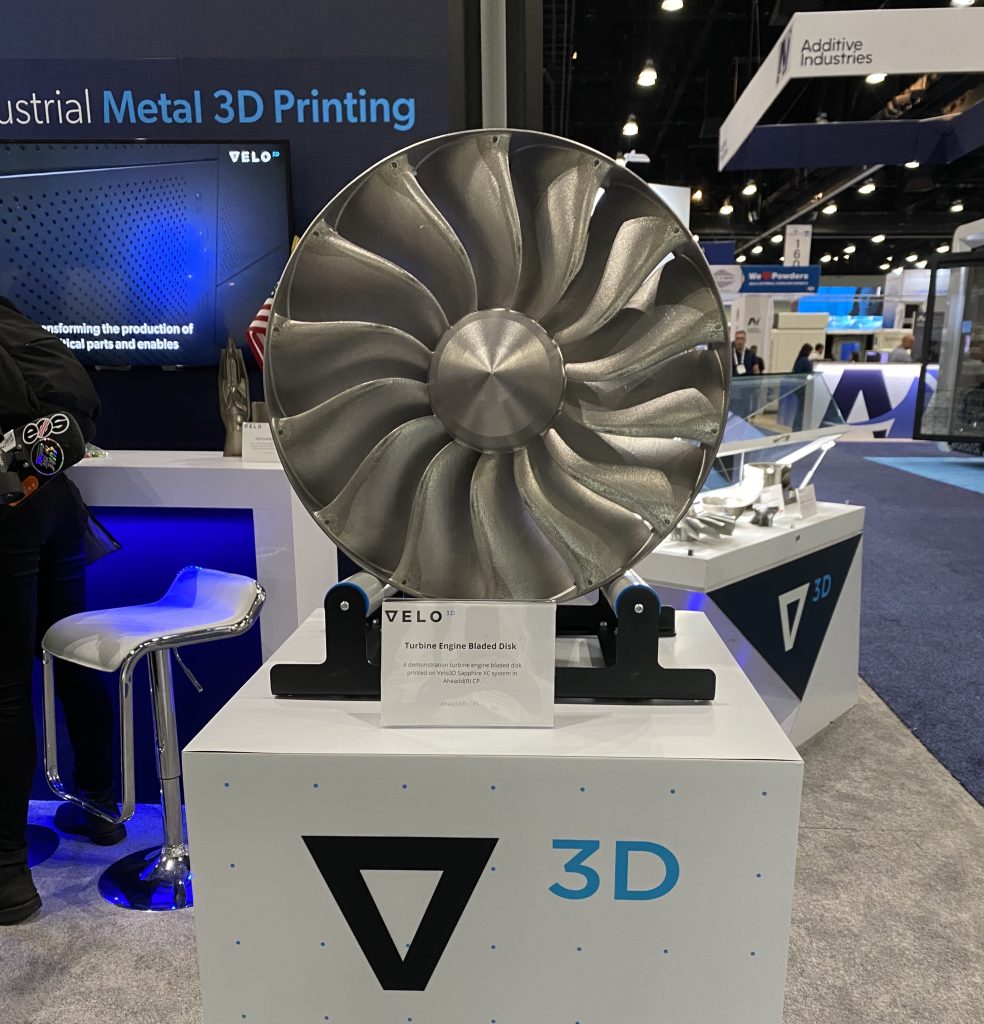

Featured image shows a Velo3D-3D printed turbine engine blade disk. Photo by 3D Printing Industry.